For most of us, there are few things more challenging than raising money for your startup. It’s a seemingly never-ending game of cat and mouse. It seems you’re either trying to chase down investors to get them to notice you and to engage with you, or they are beating down your doors – termsheets in hand! Crafting a perfect pitch deck will help you speed up the feedback loops you need to successfully raise capital, including helping investors get to the actual substance of your offer instead of getting tripped up in areas you really don’t want them focusing on (“So…your TAM is $1 Trillion, huh? Walk me through that model!”).

What’s a key difference between startups who are pursued and can generate significant interest in their funding rounds and those who fail to close their rounds? Of course there are many factors – traction, team, product, market size, and much more – but one aspect that’s often overlooked is the pitch deck and the pitch process – becoming absolutely incredible at this could save you months of time and effort.

I’ve been through many, many fundraising rounds in my day, and while it’s fun to talk about the wins – the rare time it’s actually easy to raise capital – it’s much less common to talk about the losses. The endless meetings and phone calls. The cross-country travel to meet with a potential investor. The hype surrounding some VC firm that might be pursuing you just to do some competitive research on you, only to feed that to one of their portfolio companies. The “meh” meetings where you don’t really know where you stand. The long time it takes to get a “no.” The lack of any follow up at all.

Startups that become great at raising capital often have a lot going for them. But many of them had a head start with their pitch.

In this post I’m going to walk you through how to craft a perfect pitch deck.

I’ve found that there are ten steps you need to cover to be successful.

Step 1: A clear & large problem

Don’t try to raise capital if you are not going after at least a somewhat large problem or pain point that exists in the market. You simply must be solving for a clear problem that many people experience. Or, you must have something so new or so unique that once people see it, they can’t live without it. Chances are, you don’t have that thing. So unless you truly are exceptional – and have something so amazing that people can’t live without it – at least make sure many people have the problem that you solve for.

And make sure it’s a big problem!

Notice below I point out that over 1 million startups are founder…and most fail! That’s a huge problem!

Step 2: Your solution that solves this problem

What’s a product without being a solution to a problem? This is where you need to really stand out and show how you (or more likely your product) solves this big problem you identified in step 1.

How well does your solution solve the problem?

What does it solve for now vs what will it solve for in the future?

It’s OK to not have every feature and have every roadmap item lined up. In fact, there are huge advantages to shipping your product and releasing it to real users early.

However, give yourself permission here to be aspirational – paint the picture of what the future might look like and how your future product solves the big problem.

Step 3: Demonstration of your product or value

If you have a product, show it! If what you sell is a service, explain it.

Make the audience understand how you provide value (and yes, solve that problem) with your product or solution.

Keep this short – nobody wants to spend 5 minutes seeing a demo of your product at this point (unless you truly have something exceptional…and if that’s the case, let them ask for more!).

Step 4: Social proof

I really hope you are not trying to raise capital without having anyone who you can call on to rave about your product. If you have no customers yet then stop here. Go find some. Don’t try to raise money without having some actual usage or some promise of early traction.

If you do have a product in market but you can’t get someone to say something positive enough to put into your deck, stop here. Go find that customer.

If you do have happy users or customers, ask them for a testimonial, quote, or something else that you can show in your deck. Ideally you have at least 3 points to brag about – even showing real client logos is better than nothing, and name brand customers can go a long way for building social proof.

Remember – you’re presenting to someone who might not know anything about your business other than what you’re showing them right now, so stay fairly high level.

Step 5: Revenue model & projections

This is an absolutely critical piece of the deck, but it’s too much to cover in detail here. Simply put: have a real looking financial and growth model that you can explain – in plain English – about:

- How you make money

- What your revenue model is (transactional or subscription, marketplace, service…)

- What your last couple months of revenue or user growth was

- What the next 1 to 2 years will look like

This should be demonstrated using columns ms that show your growth over time.

Step 6: Market size & opportunity

Similar to needing to solve a big problem, you need to be in a big market with a large opportunity.

Do not try to raise money if you can’t build a bottom up or top down total addressable market model, including showing how you get to that number. If you’re not following me here, I’d suggest you check this out.

Ideally you have your TAM, SAM, and SOM buttoned down, and you can take tough questions from investors about how you calculated what you showed.

Step 7: Traction & path to success

Nothing beats traction.

Nothing beats traction.

Traction is the solution to most of our problems when it comes to fundraising.

This is your chance to show the metrics that you feel most accurately represent “success” and growth for your startup, and to hopefully show 2-4 months worth of these metrics going up and to the right.

Here is an example chart I used in our Growth University Angel round fundraise. Can you guess what this represents?

Step 8: Team

Toot your own horn.

Promote your team.

Show why you are awesome and why the team you’ve built will win this market!

Here is my team slide from our Angel round. Notice what I include, and what I leave out.

Step 9: Your ask

It’s actually shocking how many times I’ve had a founder get to the end of their pitch and just end without asking for money.

You need to ask for money! Tell your potential investor how much money you want to raise. Let them know what the valuation or the CAP is – if you don’t know it, say that. If you have some of the money committed and you feel confident you’ll close it, then use that as part of your ask.

Ending here with “Thanks” and skipping the ask part is a lot worse than saying “We’re raising $500,000. We have roughly $300,000 allocated so far. We’d love for you to come in at $50,000-$100,000. Our valuation is $5M pre-money.”

Be specific. Be confident. Ask for money. That’s why you are here.

Step 10: The closing

Thank your attendee(s) for coming.

Do a very quick closing summary – something like “Thank you all so much for being here today. I can be reached at [[your email]]. I do have time for Q&A, what questions can I help answer?”

If it’s crickets, that’s OK. Sometimes it takes a while for someone to formulate a question. Count to 10 slowly in your head and if there are still no questions, then thank everyone again, and you can wrap it up.

If you do get questions, be ready to dive in.

Thank you for reading! I hope you enjoyed this post. If you did, you may love my short “Fundraising for startups” program. Learn more here.

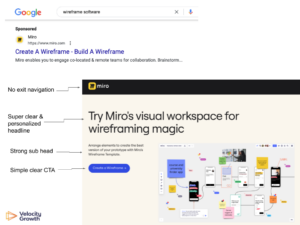

Jen is an award winning paid acquisition specialist with an honours masters degree in Digital Marketing Strategies. She is the founder of Co-founder & CMO at Velocity Growth. Jen has extensive experience working with start-ups, marketing teams and founders on their paid acquisition both in an agency and in-house capacity. She has helped companies across Ireland, UK and USA leverage phenomenal growth both nationally and internationally through paid acquisition channels.